Unhooked: Alt-Seafood Startups Face Headwinds Despite Urgent Need for Fish-Free Solutions

6 Mins Read

San Francisco-based New Wave Foods and Germany’s Ordinary Seafood have become the latest casualties in the alternative protein sector, spotlighting the troubles experienced by the vegan seafood category in recent times.

In a short space of time, New Wave Foods and Ordinary Seafood have been forced to cease operations. In what is already a tiny space in the alternative protein world, plant-based seafood has faced major headwinds lately.

New Wave Foods said it was unable to pay its debts in full, and is now set to liquidate its assets, while Ordinary Seafood fell victim to the increasingly volatile funding landscape for food tech. It has left the alternative seafood sector reeling, but industry members are hoping to mobilise efforts to continue its growth in the face of climate change.

New Wave Foods and Ordinary Seafood cease operations

In November, New Wave Foods entered into a voluntary assignment for the benefit of the creditors (ABC), an alternative to formal bankruptcy proceedings that involves transferring assets from a debtor to a trust to liquidate them and distribute the proceeds. In effect, the company was “indebted to various creditors” and “unable to pay its debts in full”.

Creditors have a mid-May deadline to submit claims against the business, which rolled out its vegan shrimp in US foodservice through a partnership with Dot Foods in 2021, months after closing an $18M Series A fundraiser. “Although we were gaining momentum in 2023 and had secured a major customer for 2024 sales, we couldn’t outrun industry headwinds,” New Wave Foods co-founder and CEO Michelle Wolf told AFN.

“Our focus had been on healthy business fundamentals since I became CEO in late 2021 and I’m proud of what we achieved. I believe New Wave has been one of the stepping stones toward more sustainable eating, whether by delighting diners, inspiring competitors, or advancing plant-based innovation,” she added. “I continue to have faith in the industry’s long-term success, but the environment we’re in will continue to push companies to prioritise like we did and explore innovation horizons.”

Similarly, earlier this month, German player Ordinary Seafood’s operations came to a head, with founder and CEO Anton Pluschke announcing the development on LinkedIn. The two-year-old brand had just introduced its vegan tuna and smoked salmon at METRO outlets across the country in November, but a bleak, “dramatically changed” funding landscape led to its demise. “We have had to make the incredibly difficult decision to wind down operations and let go of our outstanding team,” wrote Pluschke.

In a email to Green Queen, Pluschke underlined the importance of industry collaboration and cautioned that major food system change will take time: “While we have seen tremendous recent improvements in conventional animal-based food analogues, we should not pretend that transforming global food systems will happen overnight. While entrepreneurs focus on developing new ingredients, engineering novel processing technologies, build new brands and sales channels, the successful transformation of the food industry requires collaboration and involvement from all stakeholders including government and policymakers, producers and farmers, food industry companies, consumers, research institutions, supply chain partners and investors and financial institutions. Getting this right will require a unified voice, a true collaborative effort for improved planetary health. We do not have time for dangerous hype cycles, we need a deeper understanding with real commitment and true partnership.”

In a statement sent to Green Queen, Marissa Bronfman, founder of alternative seafood association Future Ocean Foods, which counts over 30 members, said: “We at Future Ocean Foods are all saddened that Ordinary Seafood is ceasing operations, an event precipitated by an extremely difficult fundraising environment for plant-based food and not reflective of the company’s fantastic alt-seafood products and passionate team.”

She added: “I applaud Anton for his exemplary leadership and know that we will continue to see incredible innovation from this visionary founder.”

The vegan seafood sector is dwarfed by plant-based meat and conventional seafood

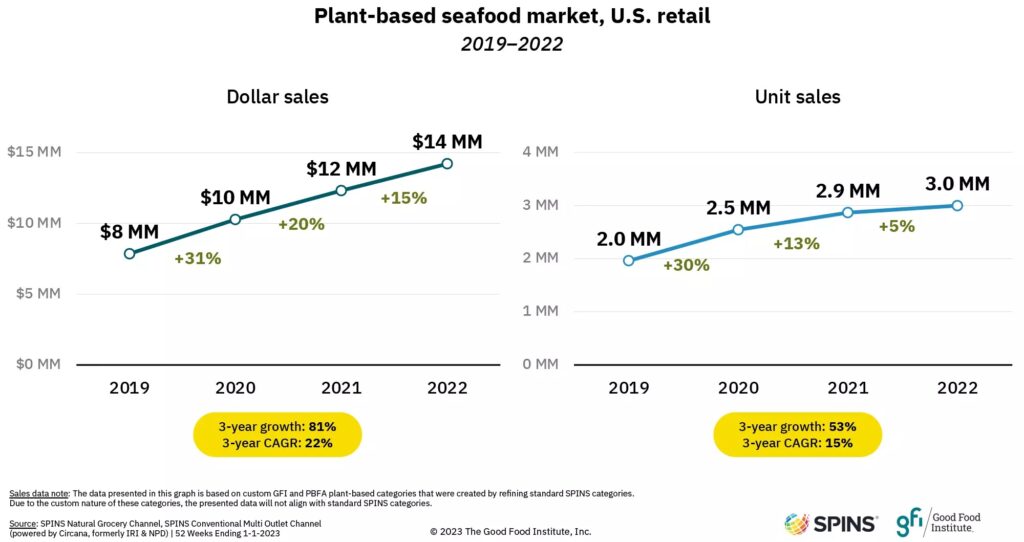

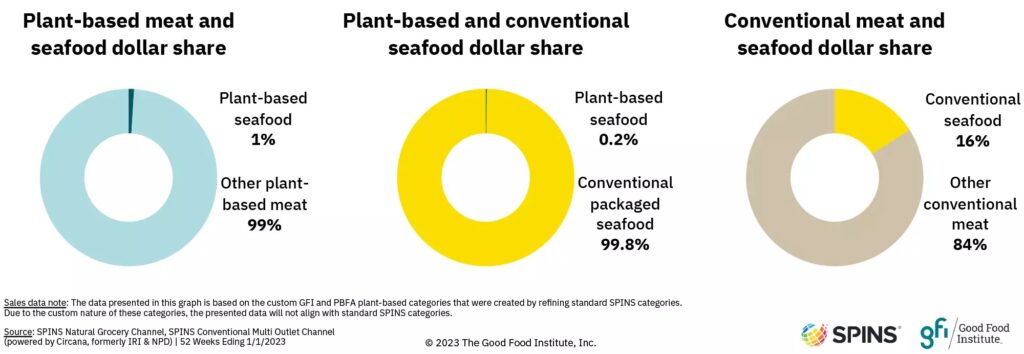

It marks the end of two brands that were helping disrupt the $8.5B global seafood market. Despite vegan seafood outpacing the plant-based meat sector to deliver growth in both unit and dollar sales from 2021-22, its retail sales only hit $14M, a minuscule 1% of the $1.2B made by the overall meat analogues category. Its contribution to the overall seafood sector is even smaller, representing just 0.2% of total sales.

There have been some success stories recently, of course. Yves Potvin’s Konscious Foods has its frozen vegan sushi and poke bowl SKUs in over 4,500 retail doors in North America; Nestlé – the world’s largest CPG brand – introduced three plant-based seafood products in Europe and Asia recently; and Sweden’s Hooked Foods expanded into Germany with a listing in 400 REWE West stores in November.

But New Wave Foods and Ordinary Seafood’s fate underlines the seafood sector’s unique adoption problem. While many consumers are looking for plant-based alternatives to red and processed meat due to their associated health risks, for others, seafood is the solution. Research by the Aquaculture Stewardship Council in 2022 – covering over 12,000 consumers in 12 countries – revealed that health is the primary driver for buying seafood, with over 80% agreeing that including fish in their daily shopping is important for health.

This highlights a lack of awareness from consumers about the ills of the seafood industry. Microplastic pollution, toxic chemical runoff, antibiotic and pesticide use, sea lice and mercury all affect the seafood we consume, which inevitably enter our bodies too. This is before you consider the environmental impact of overfishing, which exacerbates biodiversity loss and could lead to a collapse of global fisheries by 2048, as well as the human rights abuse rampant in the industry.

Last month, a new study by agrifood campaigner Feedback International and a coalition of West African and Norwegian organisations accused Norway’s seafood salmon industry of ‘food colonialism’. A significant portion of fish oil for feed comes from Northwest Africa, a region suffering from acute food insecurity. But if these fish hadn’t been turned into oil, they could have provided four million people in the area with a year’s supply of fish.

And in the US, the Supreme Court is considering overturning the Chevron deference, after hearing two cases from fishing vessel operators appealing against a lower court ruling that mandates commercial fishing companies to pay for a government-run programme to monitor for overfishing. If the doctrine is overturned, it would allow unchecked overfishing and remove accountability from the sector, leaving global waters open to exploitation.

Turning crisis into opportunity

We need alternative seafood more than ever as global appetites for fish are stymied by environmental and ethical concerns. With at least 120 companies working with alternative seafood (as of 2021), consolidation may be key. This is exactly the path Wicked Kitchen has taken, first taking over Good Catch in 2022, followed by its Current Foods acquisition last year.

“Despite challenging times for the category, there is no denying that we are in a climate emergency and that our oceans are in peril,” said Bronfman. “We must ensure that the international venture community continues to fund alternative seafood across plant-based, fermentation and cultivated, if we are to protect our oceans and feed 10 billion people by 2050.”

Maarten Geraets, a food industry executive veteran and former managing director of alternative protein at Thai Union, compared the seafood sector’s issues with that of plant-based meat last year, which saw companies shut down, lay off staff, lose money, and consolidate. “It’s not so surprising,” he said.

“Alternative seafood companies should focus on resizing to lengthen runways/match sales forecasts, engage existing investors with renewed plans, seek support to handle the dip, prepare for eventual growth (which will come), and explore collaborations/partnerships with like-minded players, making an opportunity out of the crisis.”